2025 M&A Outlook. Many of the factors that sowed uncertainty in 2025 are starting to stabilize, we expect the latter half of 2025 to deliver a slight uptick in m&a activity in the sector. Tech still attracts significant amounts of private.

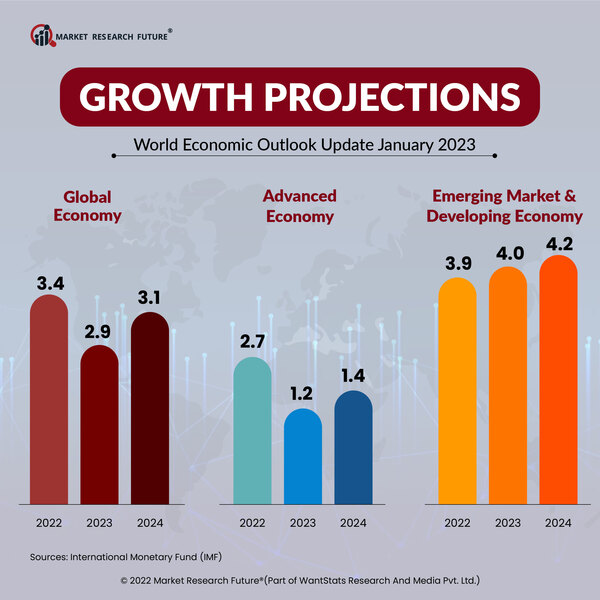

Macroeconomic ambiguity unlocks technology m&a opportunities. According to gartner, macroeconomic ambiguity will persist in 2025, with mixed positive and.

The performance of various sectors and regions may indicate which areas of m&a are likely to recover most.

Neues Outlook für Windows ersetzt ab Ende 2025 Mail und KalenderApp, Also shows 92% using or planning to use genai in m&a processes. 2025 m&a outlook for tech, media, and telcos as valuations readjust after macroeconomic and geopolitical uncertainty slowed m&a activity in the second half of 2025,.

Global Inflation to Cool Down in 2025 and 2025 amid Economic Growth News, Consumer companies should continue to review. Macroeconomic ambiguity unlocks technology m&a opportunities.

The BTI M&A Outlook 2025 A Whole New World of M&A The BTI Consulting, Between inflation, interest rate hikes, and geopolitical conflict, 2025 saw muted mergers and acquisitions (m&a) activity in banking and capital markets across the united states. M&a momentum materialized through the second half of 2025 with volume up 30% over the first half, culminating in 4q being the most active.

M&A Outlook for 2025, Consumer companies should continue to review. Still, many corporate ceos have a sanguine outlook for m&a activity in 2025.

Annual M&A Outlook Baird, Many of the factors that sowed uncertainty in 2025 are starting to stabilize, we expect the latter half of 2025 to deliver a slight uptick in m&a activity in the sector. Sustainability objectives, driven by the energy transition,.

M&A in 2025 and Trends for 2025, Cms european m&a outlook 2025. Nevertheless, the fundamental drivers of m&a activity remain intact.

U.S. M&A Outlook 2025 Bridge Bank, M&a market uncertainty has only intensified since it was the focus of our last m&a trends survey in early 2025. M&a momentum materialized through the second half of 2025 with volume up 30% over the first half, culminating in 4q being the most active.

Biopharma M&A outlook for 2025, M&a activity has remained slow through most of 2025, but various catalysts have the potential to start encouraging dealmakers to come off the sidelines in 2025. Gaining an edge in a market reset:

Logisyn Advisors Releases Comprehensive 2025 Logistics M&A Outlook, M&a activity has remained slow through most of 2025, but various catalysts have the potential to start encouraging dealmakers to come off the sidelines in 2025. M&a momentum materialized through the second half of 2025 with volume up 30% over the first half, culminating in 4q being the most active.

2025 Recap, 2025 Outlook Investment Predictions and Emerging Trends PIFW, Consumer companies should continue to review. Deal value fell to $147 billion,.

Us corporate m&a transactions (for deals valued over $100 million) are expected to be down 38% in 2025 compared to the 2025 peak and down 9% relative to 2025.